Understanding Investment Management CRM

The right Customer Relationship Management software, in today's fast-moving financial environment, is going to make all the difference for the investment professional-whether in venture capital, private equity, hedge funds, or asset management. A personalised CRM solution effectively organises the operations, and there is improved interaction with clients, and thus growth. How to choose the right software, this comprehensive guide looks at some of the best CRM solutions in investment management.

Understanding Investment Management CRM

Investment management CRM software addresses highly unique needs for professionals in that field. Naturally, a great number of these systems offer far more advanced functionality than those used to manage contacts, tracking of portfolios, tools of regulatory compliance review, and performance analytics. With it, one can maintain client relations better for maintaining competitive advantages as an investment manager.

CRM for Venture Capital

Why Venture Capital Firms need CRM

This is because there is a large number of startups that a venture capital firm has to deal with. Monitoring and follow-up require much, which is streamlined by the CRM for venture capital by offering deal tracking tools, pipeline management, and performance reporting. This will help firms enable fast and accurate informed decision-making.

The Best CRM for Venture Capital

The good venture capital CRM would eventually provide deal flow management, investor relationships, and portfolio performance tracking. Applications like Hubspot have designed dashboards that bear customised features, integrated to allow easy access to data for decision-making.

Best CRM for Private Equity

Private equity firms use CRM solutions for their complex deal structures, investor tracking of commitments, and performance insights for the portfolio. Rich reporting capabilities, tailored workflow customisation, and security make it the most complete private equity CRM. Systems such as Altvia are designed on purpose for this cause; they provide smooth integrations with financial databases and compliance frameworks.

CRM Software for Financial Advisors

Financial advisors love using CRM software when it comes to managing customers' portfolios, tracking goals, and even advising. In this regard, the effective CRM for financial advisors should have automated communications, comprehensive client profiles, investment tracking, and more. Navatar delivers these functionalities in a way that ensures an advisor can provide tailored strategies in finance and maintain relations with his clients.

Hedge Fund CRM

Importance of CRM in Hedge Funds

Hedge funds work on a high stake environment where time is very crucial to decisions. The hedge fund CRM encompasses the facilities for risk assessment, investor management, and performance analytics. Such systems will support the fund manager to be more informed and responsive towards the altering market conditions.

Best CRM for Hedge Funds

The best CRM for hedge funds will be those that will merge advanced analytics into user-friendly interfaces. Real-time analytics, reporting tools, and applications to enable regulatory compliances will make most of these applications worth investing in. Indeed, Navatar, stands outstanding in this regard-bringing in worth insights on the course of performance optimisation into hedge fund investment relationships.

Private Equity CRM Software

The private equity CRM software should manage complex investment data and enable collaboration among team members. Some key features for this would be deal tracking, document management, and investor communication tools. Web Alliance custom crm offers all these capabilities that are significant in helping a private equity firm handle its portfolio efficiently and maintain good relations with its investors.

Best CRM for Investment Management

The best CRM to manage investments would be one-stop in its feature set, offering functionality right from client acquisition to retention. Some of the key features that it should have include high-end analytics, secure data storage, and smooth integration with existing financial systems. Bespoke CRM from Web Alliance comes highly recommended due to its wide array of tools answering many questions by investment managers.

Best CRM for Asset Managers

That is, portfolio management, client reporting, and performance analysis are some of the things asset managers want to see within the suite of CRM software. Additionally, intuitive interfaces, customised dashboards, and flexible analytics mark the best CRM solutions for asset managers.

The right CRM chosen shall help cater to the needs of investment management to stay competitive and nurture relations with clients. The proper kind of CRM solution would, therefore, streamline operations, make better decisions, and surely provide better service from different firms operating in the asset class, which includes venture capital, private equity, hedge funds, and asset management. Consider what your firm needs; study what kind of CRM solutions are around to get the best fit for your company's needs.

For more insights into optimising your investment management process, please contact us.

FAQs

Q. What is an Investment Management CRM?

Q. How will an Investment Management CRM help my firm?

Q. What to Expect from an Investment Management CRM?

Q. Is the Investment Management CRM from Web Alliance Ltd secure?

Q. How to integrate CRM in Web Alliance Ltd. into my operational systems?

Related Blogs

Transforming Customer Support with Web Alliance`s CRM Solutions

What's more, with the electronic world of fast-moving …

Why Businesses Need Custom Document Management Software Benefits Features How to Get the Best

The document management system is a software solution that …

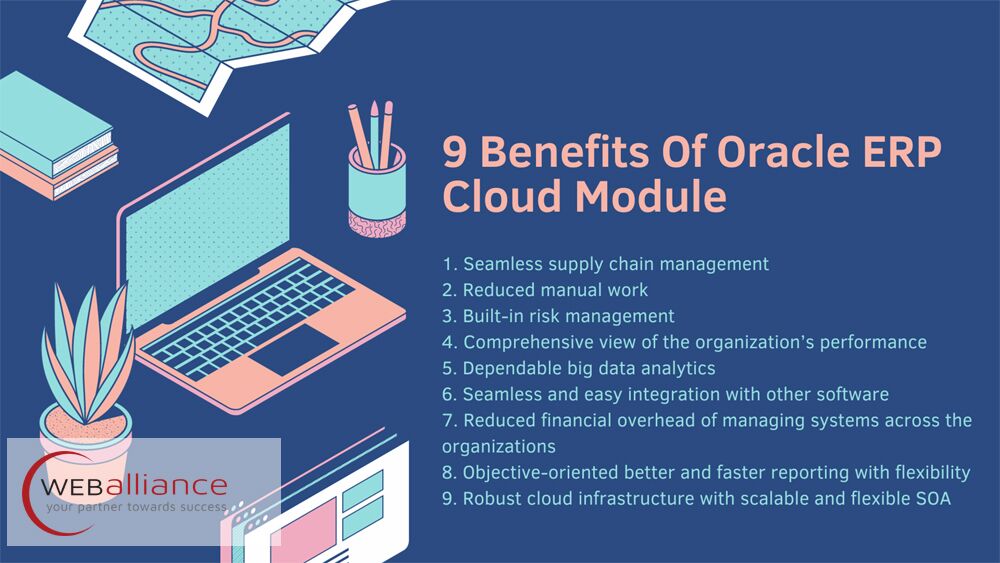

Top 9 Oracle ERP Modules You Should Ask a Custom ERP Software Developer

Enterprise resource planning (ERP) modules have become a …